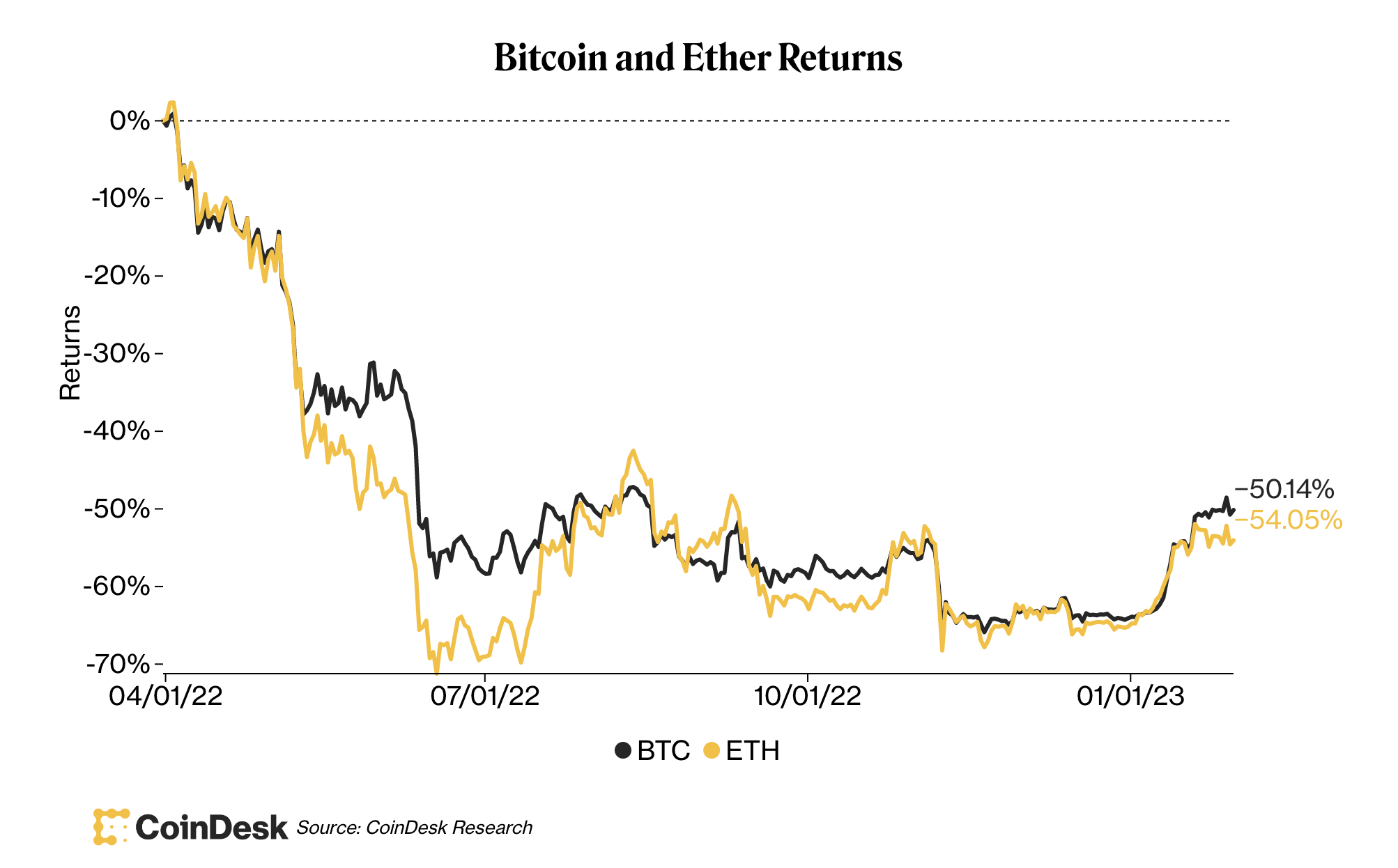

It’s clear that 2023 feels better than 2022. After a 60% decline in Bitcoin (BTC), ether (ETH), and other currencies, they have risen by 39% and 33% respectively so far this year.

The U.S. Federal Reserve seems to be winning the inflation war, improving macroeconomic conditions and increasing investors’ willingness to invest in riskier investments like cryptocurrencies. BTC and ETH both have price momentum, and their trading volume has increased, which suggests that bullish sentiment may be growing.

BTC and ETH together make up approximately 60% of the total market capitalization for crypto assets. They are succeeding in ways other players have not. You don’t need to be reminded about the problems at FTX and Genesis, Gemini or Three Arrows Capital.

The 2022 scandals and other blowups have created the conditions for a legislative and regulatory crackdown over the coming months and years. People who put their hard-earned cash into trustworthy entities lost money. In some cases, years worth of savings were lost. People who owned certain crypto currencies suffered losses due to the negative contagion and blowback that resulted. This was not an issue with crypto assets. It was the bad actors’ actions.

Where do we go from there? This week, a couple of things caught my attention. First, the Jan. 27 “Roadmap To Mitigate Cryptocurrencies Risis” was released by the Biden administration. The American Economic Liberties Project held a Jan. 25 forum that focused on crypto-related challenges.

These are some of the quotes and ideas I found most inspiring:

-

“Cryptofraud is a serious problem.”

Agreed. Agree. The resultant contagion has added uncertainty for almost all those involved in cryptocurrencies. This sentiment is shared by many in the sector, I would argue.

-

“While cryptocurrency may be new, the behaviors we’ve seen in cryptocurrencies and the associated risks are not.”

This is something I see no problem with. It actually goes to the core of one of my main thoughts. Individuals engaged in reckless behavior that has been around for many decades caused the chaos within the crypto sector. It was not a result of crypto. These are also things that happen outside of crypto.

Greed, fraud and cryptocurrencies are not exclusive to them. It confuses me that part of the ire is directed at the asset rather than the people who have committed fraudulent acts. If I was to be conned out of U.S. Dollars, my problem would be with the scammer and not the greenback.

-

Cryptocurrency is not being used by anyone.

This is what I refer to as the “no one buys coffee with bitcoin” argument. This is something that I always find amusing. Although I haven’t seen many people willing exchange bitcoin for coffee, they may exist. (Yes, someone did pay 10,000 BTC to get pizza in 2010. It was delicious, I hope.

There are many arguments to support the notion that bitcoin is 1) a store-of-value, 2) an account unit, and 3) a medium for exchange. Therefore, I would argue that bitcoin is a currency.

Bitcoin is clearly a commodity. It has been identified as such by the U.S. Commodity Exchange Act. I would argue that commodities are bought to hedge risk and/or generate speculative profits. It can be used to make daily transactions but it is not ideal. It’s not something I would use to buy a cup coffee, but it doesn’t mean that they are useless.

-

Crypto is magic money that can be used to buy or trade drugs online.

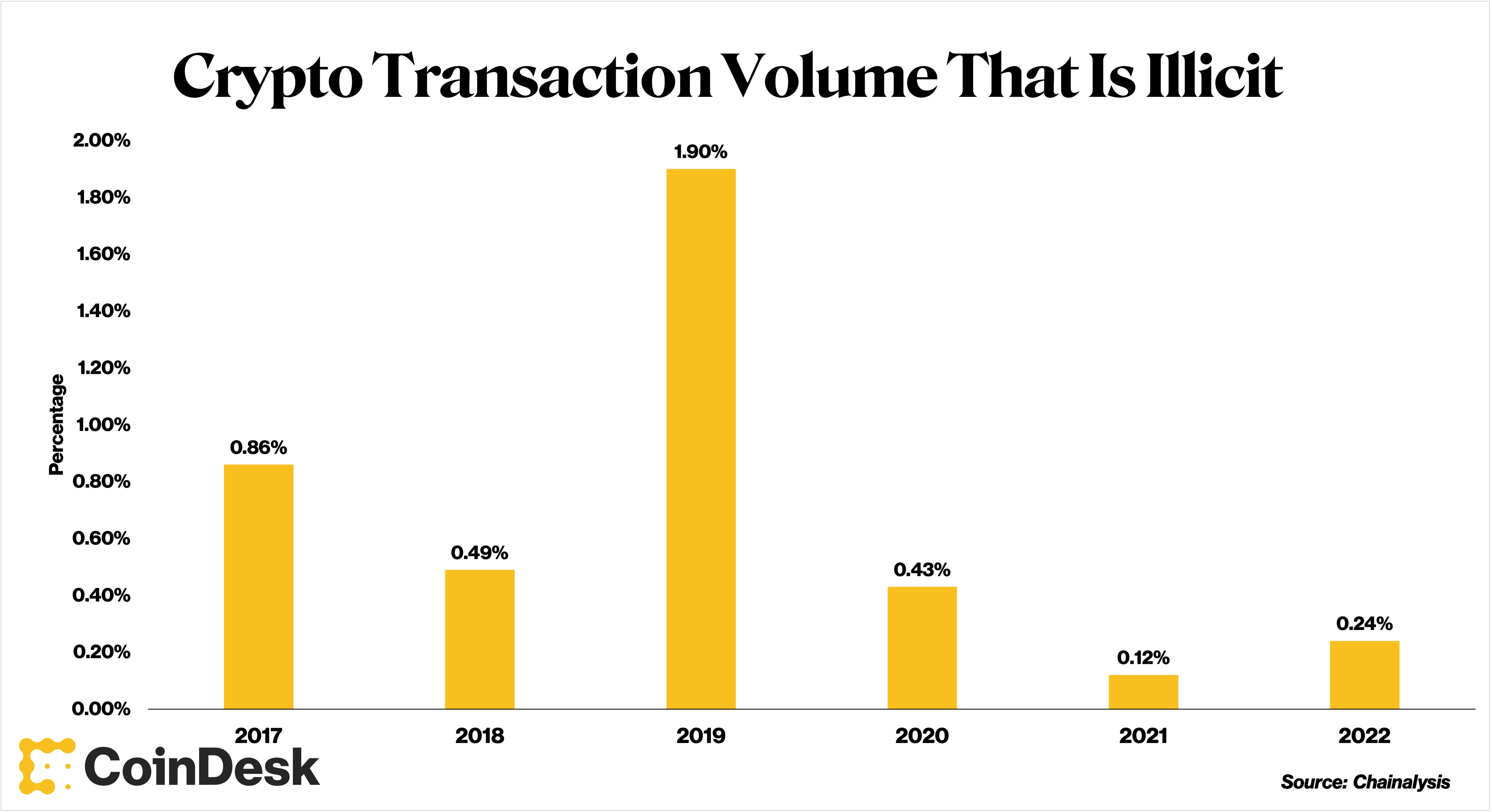

This is a very broad mischaracterization of crypto community. (Also I would argue that anyone who believes it is a good idea for illegal narcotics to be purchased via a publicly visible blockchain is not thinking clearly. To be fair to all those who are agitated about this, there are many ways to hide illicit transactions, including the use privacy coins. Chainalysis’s recent report shows that only 0.2% of cryptocurrency transactions are attributed to illicit activity. This represents a significant increase over 2022 and an all-time high at $20 billion.

While illegal transactions can certainly be made via crypto, I believe more attention should be given to the 99.76% that aren’t.

-

Crypto is not meant for financial inclusion.

This is something I strongly disagree with. Both inside and outside of the U.S., people of color are often denied the opportunity to own assets through traditional finance. Their motivation to gain exposure to crypto (either through ownership or understanding) is partly to avoid being outsiders. It is an attempt to get a foothold quickly, before it becomes more difficult to do so. This is similar to traditional finance.

It’s implied that people in these communities don’t understand the risks involved. That is something I disagree with. I also believe that there is tremendous opportunity not only in financial inclusion, but also in bridging digital gaps. Initiatives that allow underrepresented communities to have access to crypto on the basis both of asset ownership and learning about the technology behind it are welcome.

-

Cryptocurrency is only for speculation.

This seems odd to me, as I believe crypto is used for speculation. That’s fine by me. Any asset that I buy in financial markets I want to see grow in value. Sometimes it goes my way, sometimes it doesn’t. Responsible speculation is acceptable, provided that you make informed decisions, apply risk management, and have an expectation of profit or loss.

-

Cryptocurrency is a fraud.

This characterization doesn’t seem to have any positive implications for me. To the same token, I do not feel the need to change people’s minds. If anyone believes crypto is a fraud, I would encourage them to not buy it. If they believe in the asset, I encourage them to purchase it.

A shift in regulatory environment could have a significant impact on institutional investors in many ways. A sound regulatory framework could give them a better environment in which to work. Investors can have confidence in their ability to include crypto in their business plans if there is clarity.

We have seen many traditional financial players start to explore crypto waters. I expect more to do so in the future, given the right circumstances.

Overall, regulation doesn’t seem to be inherently harmful. I do think that broad mischaracterizations, however, are. I hope that legislation will be more focused on the actors and less on the asset in the months ahead.

The Future of Crypto: Tokenization

By Pedro Palandrani, Global X ETFs Director,

It is obvious that 2022 was a difficult year for cryptocurrency. There are major structural benefits that will be available in 2023, such as TradFi companies entering the space. These companies could support digital assets for many years. This goes beyond crypto’s potential as an investment asset. Blockchain technology continues to be attractive with its features such as better security, decentralization and immutability. This is especially true when it comes tokenization. Tokenization refers to the process of bringing real-world and financial assets onto a blockchain using tokens. Understanding tokenization is crucial to understand the long-term investment case of crypto assets.

There are still signs of life in security tokens, despite the crypto bear market. One notable offering was KKR tokenizing a portion of its Health Care Strategic Growth Fund II, (HCSG II). In conjunction with Securitize is a company. However, the market is still young and has a total value of around $3.5 billion. $90 billionWith $20 billion of this in secondary market, This is nothing compared to the many trillions of dollars that are stashed worldwide in real estate and equities.

Tokenized securities offer a lot of potential growth because tokenization opens up new markets on the blockchain for many non-traditional asset classes. Tokens can be used to create loyalty programs that reward their owners for purchasing a certain amount of tokens or a particular frequency. Membership non-fungible tokens, or NFT, can also be used to offer rewards like access to exclusive features, loyalty perks, and early access for new releases. Starbucks has recently begun beta testing Odyssey, a reward program that allows customers to earn NFTs through the Polygon blockchain.

Gaming has a lot of promise. Tokenization allows players to be rewarded with additional games and in-game content through a game-and earn model. Last year, the videogame industry generated around $200 billion in revenue. Only 3% of this was tied to game-and earnn. A major coup for blockchain adoption would be an expansion. This potential has led to video games projects raising 50% more venture capital. They did more in the first half of 2022 then they did all of 2021.

It is clear that tokenization can bring liquidity and value to assets that were not previously tradeable. Even with tailwinds in 2022 the creation of onchain marketplaces for these assets continues apace. This should support both the global growth of crypto assets and the long-term bull case of digital assets generally.

Takeaways

CoinDesk Nick BakerHere’s some news that is worth your attention:

-

SUPERLATIVE INFLOWS According to CoinShares, digital-asset investments received the largest inflows over six months ($117 millions). This is not a huge amount in crypto’s grand scheme, which hovers around $1 trillion. It’s a good thing to hold onto, despite how terrible 2022 was.

-

PAY WITH DOGE The Financial Times reported Twitter is creating the foundations for a payment service. The article’s headline for crypto enthusiasts is: “[Elon] Musk stated that he wants the system fiat first and foremost but designed so that crypto functionality can potentially be added at some point.” While it’s impossible to predict how Twitter will recover from its current troubles, a Musk-backed cryptocurrency payments system would appeal to some and could be a boost to efforts to integrate crypto into mainstream finance and banking.

-

BINANCE IN INDIA – OR NOT? Binance emerged as the most powerful centralized exchange in terms of clout after FTX collapse. CoinDesk’s investigation found that Binance was putting its weight behind the scenes, as it distances herself from WazirX (Indian exchange accused of aiding money laundering).