Good morning. Here’s what’s happening:

Prices: After crypto exchange Kraken announced that it would cease crypto staking operations, Bitcoin fell below $22K. However, liquid staking tokens have been an exception.

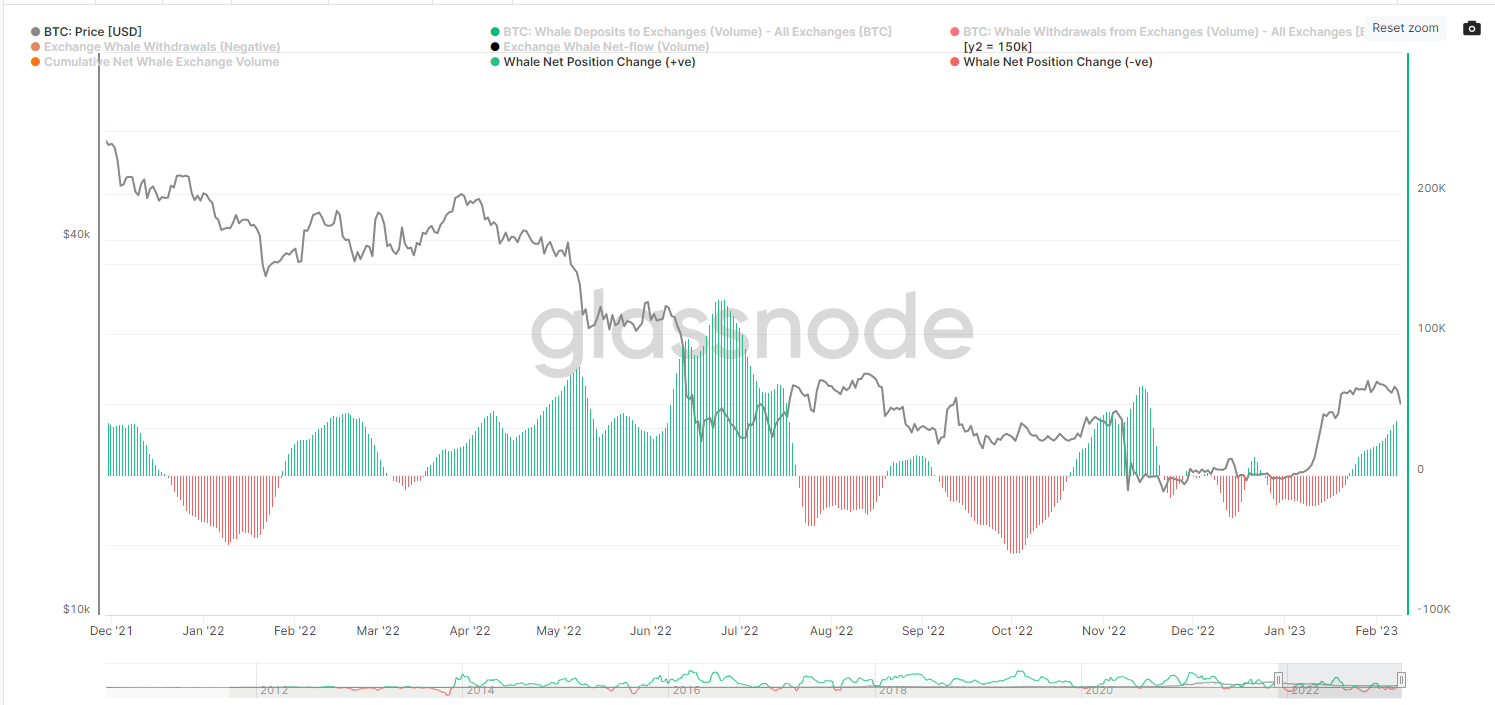

Insights: Whales send bitcoin back to exchanges while retail investors remove the asset. What does this trend signify?

Prices

A Kraken Settlement, New Regulatory Concerns, and a Crypto Decline

This much for $24,000 Or $23,000

Bitcoin plunged to $21,827 in just 24 hours, more than 5% of its previous level. This was a worrying sign for the future regulation of cryptocurrency. The decline was largely due to the fact that crypto exchange Kraken agreed “immediately” to end its crypto-staking-as a service platform for U.S customers and to pay $30 million to settle Securities and Exchange Commission charges it offered unregistered securities.

Gary Gensler, SEC Chair, stated that the settlement “should make it clear to the market that staking as-a-service provider must register and provide full disclosure and investor protection.”

Brett Sifling, an investment advisor at Gerber Kawasaki’s wealth management firm, spoke out to CoinDesk TV about the need for better regulation in order to allow “crypto to truly go to the next stage.”

Sifling stated that “innovation has outpaced the legislation which our government has proposed.” “We need blood. We need to have some trust that our government will back us. That there won’t be a Wild West with criminals in this industry. It ultimately hurts the common man.”

He said, “If we want widespread adoption, we must have these rules in order to build and have confidence in putting investments into market and knowing they won’t disappear one day when we wake up.”

Ether, the second-largest crypto market cap, performed similarly. It dropped from its previous support of $1,600 to $1,546, a 6.6% drop from Wednesday’s same time. This was part of a larger market downswing. After a five week spike, Coinbase CEO Brian Armstrong tweeted Wednesday to say that rumors had surfaced that the SEC wanted to ban retail investors participating in crypto staking. This income-generating technique is at the heart of all blockchains including Ethereum.

The majority of cryptos spent the day in negative territory. However, liquidity staking tokens were an exception as LDO, which is the governance token for Lido Finance. largest liquid staking protocol With $8.4 Billion of staked Ethereum (ETH) on the platform it jumped 10.4% in one hour. LDO rose by 2% in the last 24 hours. Rocket Pool, a competitor in LDO, saw its RPL rise and tokens on smaller liquid staking platforms like Persistence’s STAKE and StaFi’s FIS rose nicely after the Kraken announcement.

The crypto news did not affect equity markets. However, the tech-heavy Nasdaq (which has a strong technology component) and the S&P 500 fell about 1% each. Stocks rose earlier in the day as investors believed that the hot job market was cooling. This could be due to the fact that investors believe that the U.S. central banks’ monetary aggressiveness is helping to curb inflation. Even though other indicators suggest an economic contraction, the job figures have been stubbornly positive for months. This historically leads to lower prices.

Sifling, Gerber Kawasaki’s Sifling, was cautiously optimistic about crypto’s future. He noted that bitcoin had been trading in a narrow range over the past months. “Crypto had a fantastic year. The rate of inflation is slowing down. The macro factors are improving. It’s been range bound since August. “Until we get out of this range, I wouldn’t be too excited.”

The biggest gainers

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Gala | GALA | -16.1% | Entertainment |

| Terra | LUNA | -14.2% | Smart Contract Platform |

| Decentraland | MANA | -12.3% | Entertainment |

Insights

Whale Investors Send More Bitcoin to Exchanges

Bitcoin “Whales”, investors who own over 1,000 BTC, have begun to move bitcoin back onto central exchanges.

This trend is despite the fact that on-chain activity indicates that smaller investors are withdrawing BTC from exchanges.

Coin movement from exchanges is generally bullish while the reverse is bearish. This suggests that both smaller and larger investors are wrong about the direction of the market, with the former being too optimistic and the latter too downcast.

Another interpretation is that whales are simply managing downside risk as they have more to lose. However, market watchers will continue to be vigilant to the trend.

Important events.

3:00 p.m. HKT/SGT(7:00 UTC) Gross Domestic Product (QoQ), United Kingdom

9:30 p.m. HKT/SGT(13:30 UTC) Canada Net Change in Employment (Jan).

11:00 p.m. HKT/SGT(15:00 UTC) Michigan Consumer Sentiment Index (Feb).

CoinDesk TV

If you haven’t seen it yet, here’s the latest episode of “First Mover” (CoinDesk TV):

Bitcoin Exchange: LocalBitcoins to Close. Hermes Wins Trademark Lawsuit against MetaBirkins NFTs

LocalBitcoins, a bitcoin exchange, will be closing its doors this month due to the “ongoing very frigid crypto winter.” Jason Lau, Okcoin’s Chief Operating Officer, shared his analysis of crypto markets. Enclave Markets General Counsel Olta Andoni also participated in the copyright infringement case between Hermes, Mason Rothschild and non-fungible token artist (NFT). The jury ruled in favor the French luxury brand. Shawn Owen, CEO of SALT Lending, joined the discussion as the crypto lender raised $64.4M to reopen operations.

Headlines

Kraken to Close Crypto-Staking Service; Pay $30M in Fines at SEC Settlement SEC Announces CoinDesk Scoop from Thursday.

Bitcoin Punks Soar in Value: One Ordinal Punk NFT (minted on Bitcoin-native Ordinals Protocol) was sold late Wednesday for 9.5 BTC or approximately $214,000.

Three Arrows Capital Founders Launch Exchange where You Can Trade 3AC Bankruptcy Claims Open Exchange is the platform’s name. It aims to serve as a place for trading claims in relation to crypto-bankrupt firms, such as 3AC, which it estimates total $20 billion.

DeFi Giant MakerDAO Integrated Blockchain Data Provider Chainlink to DAI Stablecoin Chainlink Automation will perform specific tasks such as price updates and liquidity balance to maintain Maker’s stability.

Aave deploys Native Stablecoin GHO to Ethereum Testnet GHO joins a growing competition as other DeFi protocols also issue their protocol-native stablecoins or are moving to do so.