This article first appeared in First MoverCoinDesk’s daily newsletter that puts the most recent moves in crypto markets into context. Get it delivered to your inbox every single day by signing up.

The most recent prices

Top Stories

Polygon’s Ethereum-scaling tool MATIC token The stock has risen 8% in the last 24 hours, continuing its strong momentum for this year. MATIC traded at $1.11 recently. The MATIC is currently trading at $1.11. This is due to a 48% increase in daily transactions, making it the second most popular cryptocurrency. Daily active usersAccording to Token Terminal data, it is. Nearly a month after its deployment, Gains Network, a decentralized exchange, has seen more than $1.5 billion in trading volume using the Arbitrum blockchain. Gains Network was originally released on Polygon. It has helped to increase the number of transactions conducted on this network. It allows users trade financial derivatives of different assets such as U.S. stocks or indexes through matching trades made by smart contracts.

The cost of layer 2 network Optimism’s OP Over the past week, token also soared. Due to increasing adoption of layer 2, OP hit an all-time high at $2.50 Wednesday. “People want layer 2, and they see layer two adoptions happening,” Nick Hotz, vice-president of research at digital asset-management company Arca, said. Hotz was referring to tokens associated with companion Blockchain systems. “Optimism will get you good exposure to this theme right now.” The OP token’s rise has outpaced bitcoin and ether as digital assets, according to market capitalization. They have risen 39% & 33% respectively in 2023.

Developers Hinter Mango Markets, a decentralized crypto exchange that was shut down They claim they are moving forward with a project relaunch – even though the U.S. Securities and Exchange Commission claims that the native token of the project, MNGO is a security. Mango Markets’ “version 4” is being labeled by the SEC. This raises serious questions about whether they can continue without regulators’ ire. Mango has not been accused of wrongdoing by the SEC. However, the agency Last week MNGO trader Avraham Eisberg was accused of securities market manipulation. He drained $116million from the exchange in October. CoinDesk heard from securities lawyers not involved in the case that the SEC may be trying to file a case against the exchange, which issued MNGOs to investors in 2021.

Chart of the Day

-

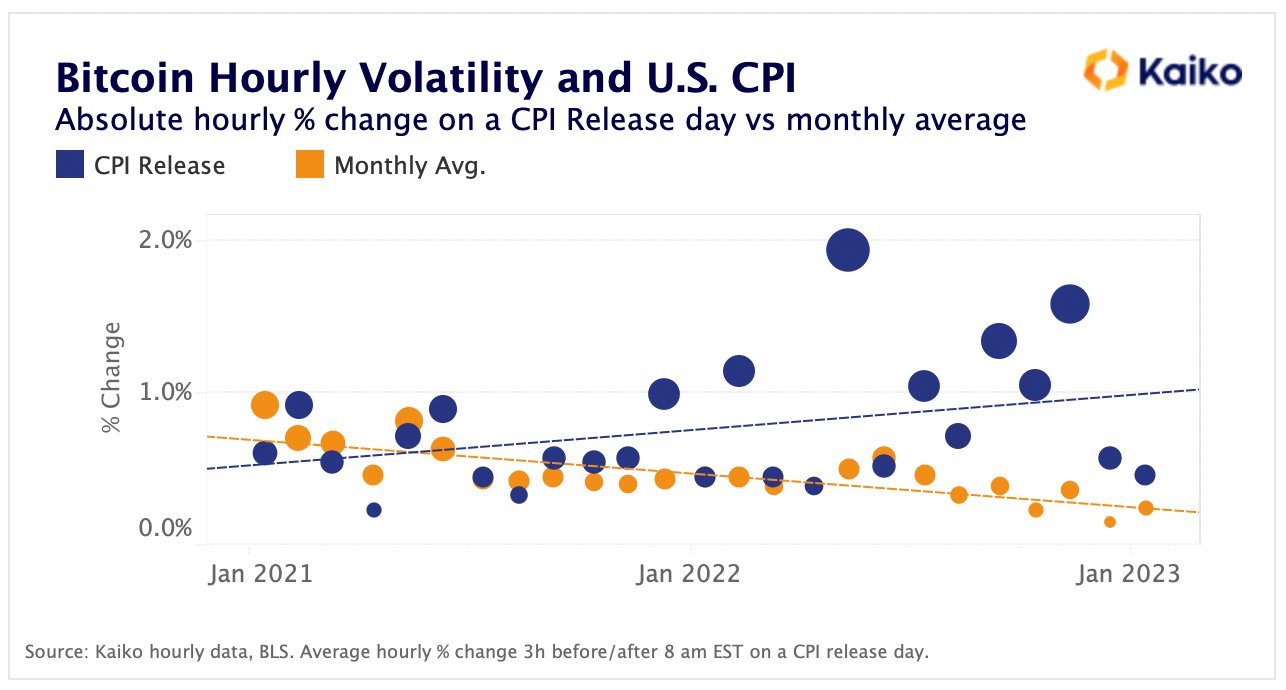

The chart shows the price of bitcoin three hours prior to and after the monthly U.S. Consumer Price Index releases since January 2021.

-

The volatility around CPI releases has risen over the past 12 month, which indicates that macroeconomic data has greater influence on cryptocurrency than ever.

-

February 14th will be the next CPI report.

Trending Posts

-

Report: South Korean Price Manipulation Probe – Crypto Exchange Bithumb Ridden by the Bithumb of Crypto Exchange

-

Sam Bankman-Fried’s Mother and Brother Are Not Cooperative With Financial Probe, FTX Lawyers Declare

-

Floki Inu Developers Float a DAO Proposal to Burn $55M Of Its Own Tokens