The most recent prices

BitcoinBTC): As traders await the Federal Open Market Committee’s decision on interest rates next week, the largest cryptocurrency market value traded at $23,100. This was 0.4% higher than it was 24 hours ago. BTC has risen almost 40% since January 1, and is on track to have its best opening year since 2013, when it surged 51%.

Equities Closed as the traders process the latest Personal Consumption Expenditures The report showed that inflation had slowed down at the end last year. Tech-heavy Nasdaq Composite rose by 0.95% while the S&P 500 (DJIA), and Dow Jones Industrial Averages (DJIA), were up 0.25% & 0.08%, respectively.

You can sign up to receive daily market updates via email every day. Subscribe to the First Mover newsletter.

Top Story

On Friday, four senior officials from the Biden administration released a statement urging Congress to “step it up” in regulating cryptocurrency markets.

-

Brian Deese is the director of National Economic Council. Arati Prabhakar is director of White House Office of Science and Technology Policy. Cecilia Rouse, Chair of Council of Economic Advisors, and Jake Sullivan, National Security Advisor, wrote that Congress should “expand regulators’ power to prevent misuses of customers’ assets… and mitigate conflicts of interest.”

-

The statement also suggested that Congress strengthen transparency and disclosure requirements for cryptocurrency companies.In addition to enforcing penalties for violating illicit-finance laws, we will also be working closer with international law enforcement partners.

-

They also offered suggestions on what Congress shouldn’t do when it comes to creating new crypto regulations. Included “greenlight”[ing] mainstream institutions, like pension funds, to dive headlong into cryptocurrency markets.”

-

Officials warned that this would be “a grave error” and “deepens the ties between cryptocurrency and the wider financial system.”

Token Roundup

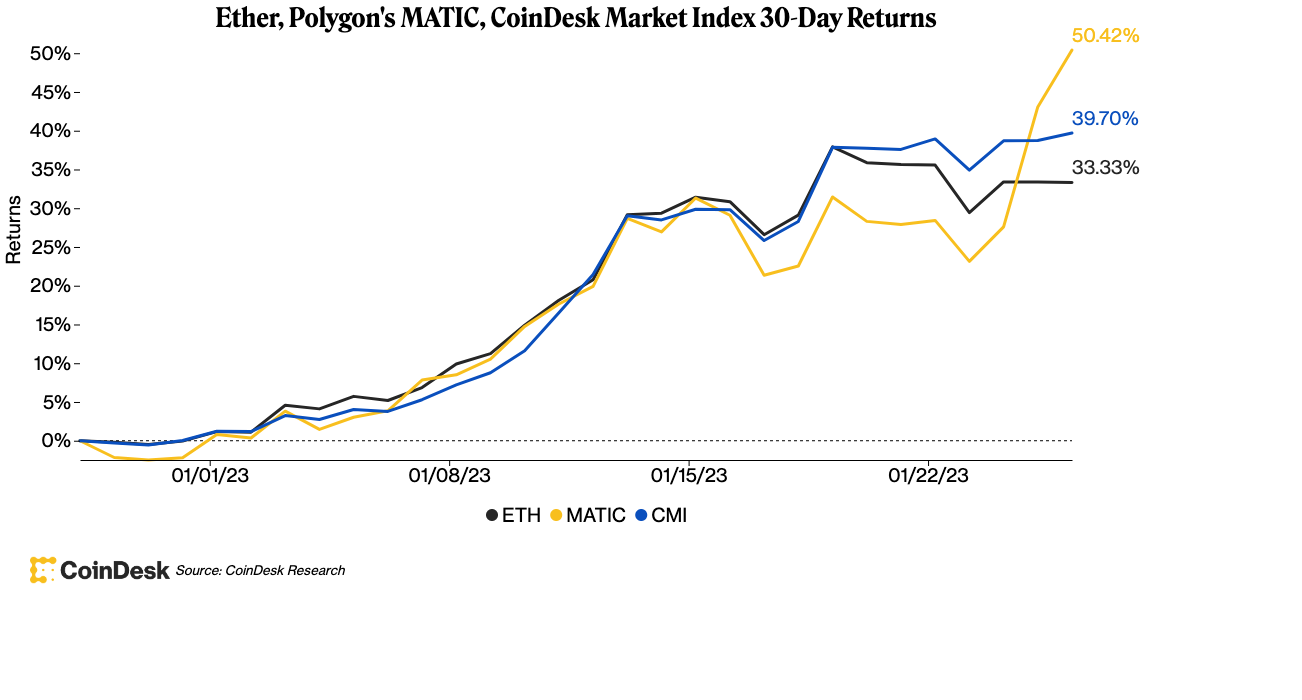

Ether (ETH): ETH traded at $1,600 in recent trades, up 0.2%

Polygon (MATIC): Recently, the MATIC token rose by 8% to $1.1 on Friday. Due to an increase in daily transactions, its price has risen 55% since December 31.

Gains Network (GNS). According to data from, the native token of decentralized currency traded at $6.20 on Friday. CoinGecko. Nearly a month after its deployment, Gains Network recorded more than $1.5 billion in trading volume using the Arbitrum blockchain.

Vela Exchange (DXP): As the Arbitrum-based, decentralized trading platform prepares for its highly anticipated beta version next week, the utility token gained around 50% on Friday. According to data from, DXP traded at $2.20, with a 26% increase. CoinGecko.

Crypto Market Analysis As investors wait for the FOMC’s next interest rate hike, Bitcoin and Ether trading activity is lessening

By Glenn Williams Jr.

Markets will be watching the Federal Open Market Committee’s (FOMC) interest-rate decision next week. It is largely expected that there will be a 25 basis points (bps) increase.

BTC’s correlation to the S&P 500 has decreased slightly in the past week. It dropped to 0.69 on Jan 11 from 0.89. Its correlation with tech-heavy Nasdaq Composite has waned slightly over the last week, falling to 0.69 from 0.89 on Jan 11.

Bullish investors need to be cautious about the stablecoin supply (SSR) ratio.

The SSR is the ratio of the supply of bitcoin to stablecoins. Stablecoins are a form of buying power. A decrease in the SSR means that investors are sending more stablecoins than usual to exchanges. This is likely to be for the purpose buying bitcoin. The SSR has increased by 32% since Jan. 11. While BTC’s value has increased, it does not seem that investors are sending stablecoins to the exchanges in large numbers to increase their long positions.

You can read the complete technical explanation here.

Trending Post

-

Listen : Today’s podcast, “CoinDesk Markets Daily”, discusses market movements and looks at the future of regulation.

-

Floki Inu Developers Float a DAO Proposal to Burn $55M Of Its Own Tokens

-

Bored Ape Artist’s NFT mint sells out so fast, many fans left mad, empty-handed

-

Crypto Bank Silvergate suspends dividend on preferred stock

-

Crypto Custodian Prime Trust to Cease Operations In Texas at the End of January

-

Bitcoin Miner Argo Blockchain Facing Class-Action Suit over US Share Sale

-

Jihan Wu’s Matrixport Reduces 10% of Staff

-

DeFi Lender Aave Deploys Version 3. Ethereum Network

-

Aptos Labs CEO Declares That NFTs Will Push Boundaries Of Previous Generation Blockchains