It has been an exciting week for bitcoin. The largest cryptocurrency in terms of market capitalization reached multiple six-month highs, before falling abruptly late Thursday. But then it rallied again.

Bitcoin (BTC), which was traded recently at $24,557, was up nearly 3.1% in the past 24 hours, and off a weekly high of early Thursday when BTC crossed $25,000 for its first time since August.

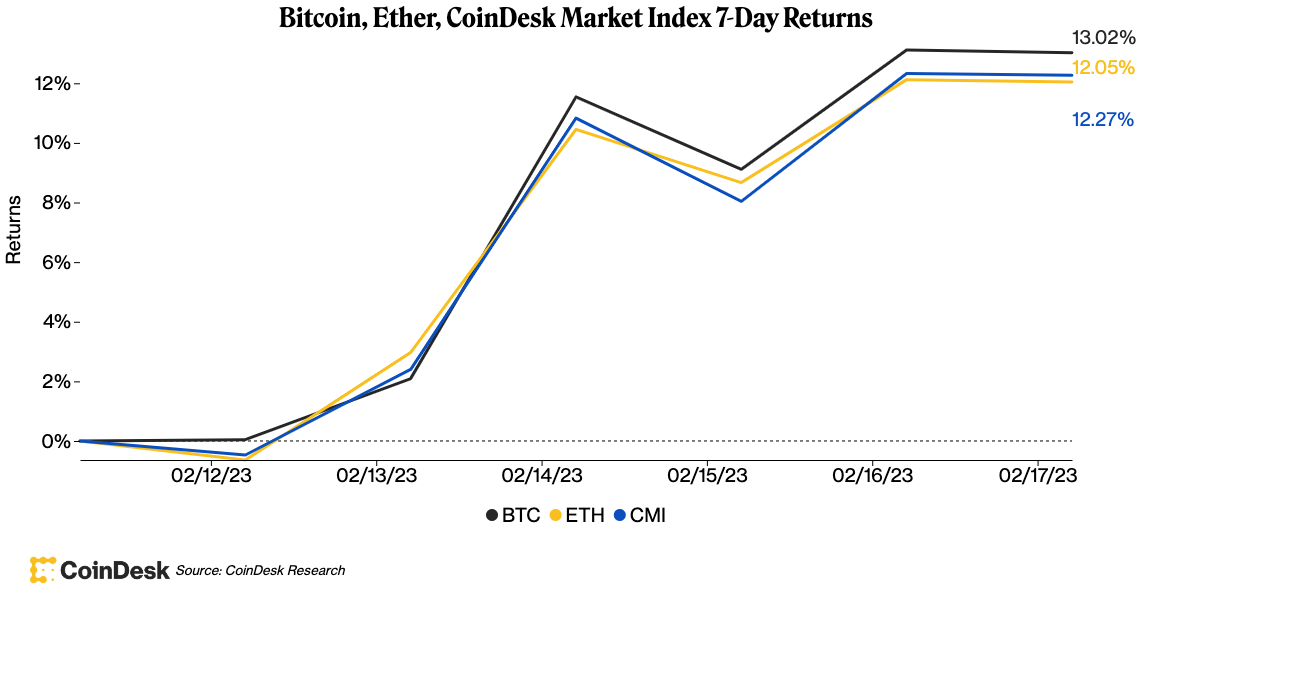

Despite the Thursday drop, bitcoin was still trading 13% more than seven days ago. There are many reasons why bitcoin rallied from its previous support of $22,000. These events highlight cryptos’ continued sensitivity to macroeconomic conditions as well as industry-specific events.

Investor optimism outweighed concerns about a stablecoin ban and the tepid Consumer Price Index. This sent bitcoin, ether, and most other cryptos skyrocketing late Tuesday. Riyad Carey from crypto data firm Kaiko said that the bitcoin upturn was “a bit like a euphoric rally” and that there have been some regulatory issues that have cooled down temporarily.

Darius Tabatabai (co-founder of Vertex Protocol), a London-based, decentralized exchange, stated earlier in the week that “we might have the makings for another bull market.”

The markets became more cautious a day later and bitcoin fell by more than $1,000 within a matter of hours. Hawkish remarks Federal Reserve officials announced the filing of a lawsuit by the U.S Securities and Exchange Commission against Do Kwon (disgraced Terraform Labs founder), and a disappointing report on wholesale prices suggesting that inflation remained resilient.

BTC’s “intermediate term overbought conditions” provide a headwind. There is significant resistance at $25,200 close by, which increases the chance of a short-term pullback. Support is close to the 200-day MA $20,000,” Katie Stockton (founder of Fairlead Strategies), wrote in an email to CoinDesk.

Oanda senior market analyst Edward Moya noted that many active traders had locked in profits after Bitcoin reached $25,000 and then failed to expand higher. The short-term appetite for risky assets may be low, which could allow for a Bitcoin consolidation so long as there is no regulatory crackdown on a crypto company or key stablecoin.

Investors seemed to have gotten over the recent discouraging news and were pushing bitcoin to just $25,000 short. Cryptos outperformed equity markets, which were closely correlated for most of 2022. Over the past week, Ether (ETH), second most valuable crypto by market value has increased more than 12%.

Moya, Oanda’s chief economist, believes that the bigger outcome of the U.S. crypto regulatory push will not be obvious for a while. This allows markets to sort themselves out and the industry itself to continue its richness in interesting projects. Moya said in an interview that there is always a time when regulators and legislators want to hear what the market thinks. He said that he hasn’t seen anything to stop the market growing, seeing investment, and having projects that could hopefully drive a use case argument for them. However, he acknowledged that stablecoins might be used to invest in other types of crypto.

Some observers believe that excessive regulation could discourage investment and create panic markets. “Based on their refusal to come to the table it’s evident that the SEC is motivated by a desire protect the financial incumbents, that is Wall Street,” Al Morris, creator of decentralized publishing protocol Koii Network told CoinDesk via email. He also said that excessive U.S. regulations could be a benefit to other crypto hubs in Europe or Dubai.

Optimism

Investors remain optimistic about crypto markets, however. The Fed will approve a second consecutive 25-basis point rate increase at its Federal Open Market Committee (FOMC), meeting in March, instead of returning to more aggressive increases in 2022. They also hope for a mild economic contraction – the so-called safe landing central bankers seek.

“While higher rates are expected to lower the value of future cash flows,” Lucas Outumuro (head of research at IntoTheBlock), wrote in a Friday newsletter.

Moya, however, noted that Bitcoin resilience has been “impressive” in light of the volatility in bond markets and constant flow of regulation headlines.

In a follow-up interview, he said cautiously: “I think that we have to live each week and right now it appears that the main objective is to put in place consumer protections. This will be the final place where people get focused on potential investigations. Part of the market seems to be used to this expectation.