Bitcoin (BTC), which was trading at $23,000, was up on Friday as traders waited for the Federal Open Market Committee’s decision next week on interest rates and any hint that policymakers might drop about when their hike campaign might come to an end.

The market capitalization of the largest cryptocurrency was $23,100. This is an increase of 0.1%.

Bitcoin has had a great start to 2023. The cryptocurrency’s price has risen by over 40% since New Years Eve. BTC has managed to remain in the $23,000 territory, surpassing $23,000 for only the second time since mid-2022.

“Bitcoin should continue to consolidate in the lead up to the Federal Open Market Committee decision (FOMC), with risks to downside if Fed sticks to itshawkish mantra,” Edward Moya wrote Friday in a note regarding the Federal Reserve’s rate-setting entity.

Traditional markets also saw slight increases, with the S&P 500 Index increasing by 0.3%.

After the most recent developments, the crypto rally took place Personal Consumption Expenditures Report showed that inflation had slowed down at the end last year, which is what the Fed has been trying to achieve with its rate hikes. CME FedWatch is currently available Shows The FOMC is expected to raise rates by 25 basis point (0.25 percentage points) at its February meeting, according to traders.

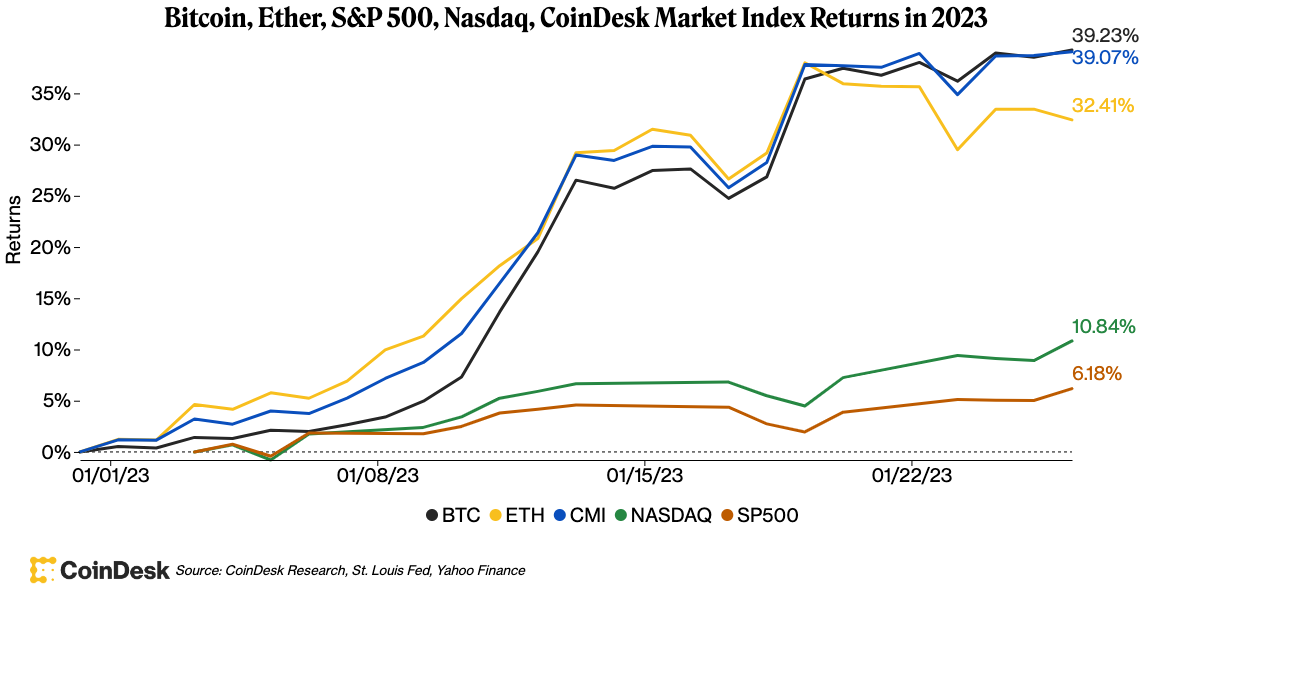

Due to the market rally, crypto assets such as bitcoin and ether (ETH), have surpassed equities in this year’s top ten: ETH is up around 32% while CoinDesk Market Index has risen 39%. Comparatively, the S&P 500 index and the Nasdaq Composite index went up 6%, 10%, and respectively.

Joel Kruger, market strategist at crypto exchange LMAX Digital stated that the current price of Bitcoin is overbought from a technical perspective, as shown by the daily relative strength indicator (RSI), which measures the extent of recent price movements.

TradingView data shows that the RSI indicator reached 81.9 on Friday, according to TradingView. (Attachments with readings over 70 indicate that an asset is too expensive.

Kruger stated to CoinDesk, that BTC’s next major event is in the works Resistance Based on August’s peak, the price to watch is around $25,000. He said that there was a possibility of BTC falling $10,000 by the end of the first half of this year or rallying to $50,000 by the end of the second half.

He said, “There’s lots of room to go either direction.” “I just wonder if there is one more shoe that can be dropped before we see the next big push.

Sourced data Coinglass The funding rates for Bitcoin currently stand at around 0.1% as of Friday. This is a sign that market sentiment leans bullish, but they are still far below the 0.06% levels recorded February or November 2021, when traders were paying 80% annually more. Long According to Lucas Outumuro (head of research at crypto data analysis firm IntoTheBlock), bitcoin is “baked,” according to a Friday newsletter.

Outumuro stated that the current level of derivatives suggests that the market is optimistic but not yet overheated. This could be a reason for the continued rally to continue.